CARES Act Information

The Coronavirus Aid, Relief and Economic Security (CARES) Act was passed by Congress and signed into law to provide economic relief from COVID-19. One section of the CARES Act established the Higher Education Emergency Relief fund and sent money to schools to use for emergency financial aid grants to students for expenses related to the disruption of campus operations due to the pandemic.

Higher Education Emergency Relief Fund Quarterly Reporting

2023

2022

2021

2020

CARES Act Summary as of June 30, 2021:

Original Allocation

SWIC Overall Allocation

Student Emergency Fund (min 50%)

$4,677,515.00

$2,338,758.00

Student Disbursements

Spring 2020

Summer 2020

Fall 2020

Spring 2021

Semester Totals to Date

Total Number of Disbursements to Date

$1,265,879.00

$3,000.00

$577,061.00

$365,249.00

$2,210,189.00

4,313

Remaining Allocations

Student Emergency Fund

Semesters Totals To Date

Remaining Funds To Be Disbursed

$2,338,758.00

$2,210,189.00

$128,569.00

Reflects the final quarterly posting for the CARES Act. The remaining grant dollars were expensed through CRRSAA

CARES Act Reporting Totals

Date

June 30, 2020

Sep. 30, 2020

Dec. 31, 2020

Mar. 31, 2021

June 30, 2021

Total Students

3,010

3,065

3,335

3,417

3,616

Total Disbursements

$1,287,072.00

$1,345,907.65

$1,830,479.00

$2,043,494.00

$2,210,189.00

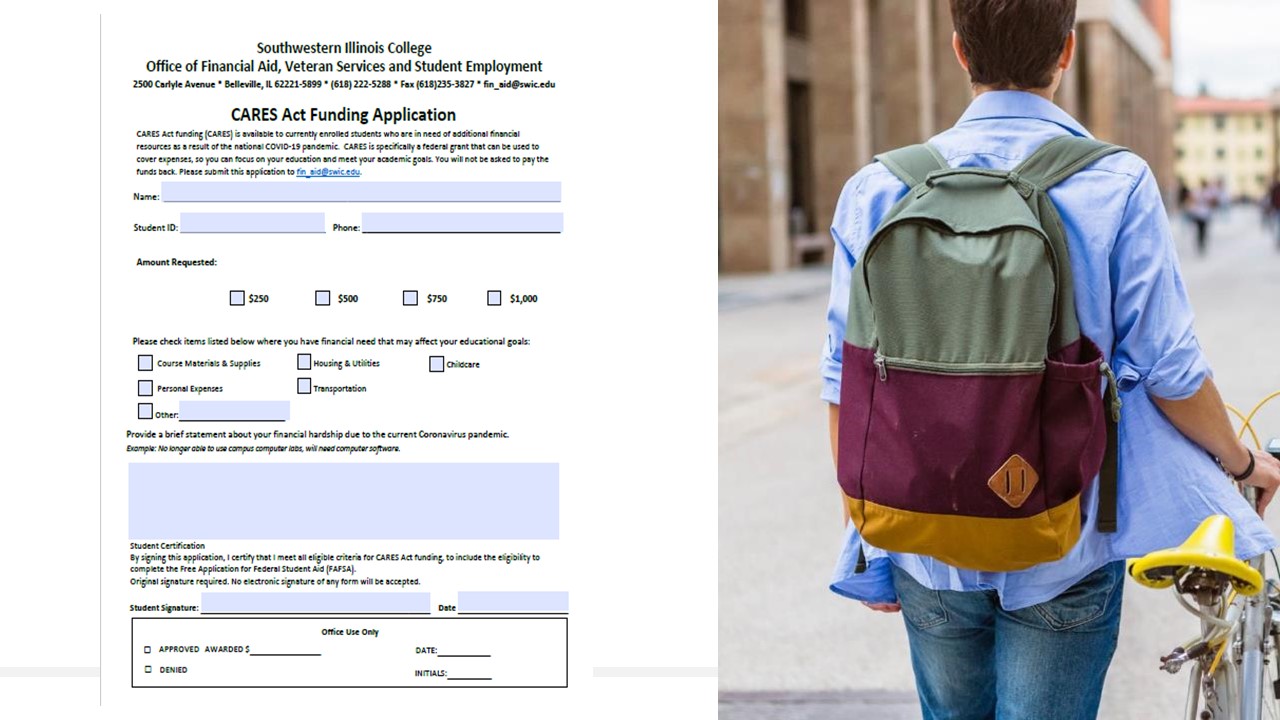

CARES Act and Higher Education Emergency Relief Fund

When Will The CARES/Higher Education Emergency Relief Funds Be Available?

Eligible students will be notified of the CARES Act disbursement via their SWIC Student e-mail. Refer to the informational PowerPoint above for more information. Questions regarding CARES Act disbursements can be directed to CARESAct@swic.edu.

CARES Act And The IRS

Higher Education Emergency Relief Fund and Emergency Financial Aid Grants under the CARES Act

The IRS has posted information about the CARES Act and how it can affect your taxes and financial aid. Click the link below to go to their website: https://www.irs.gov

Students who have received an emergency financial aid grant under sections 3504, 18004, or 18008 of the CARES Act for unexpected expenses, unmet financial need, or expenses related to the disruption of campus operations on account of the COVID-19 pandemic. Should this grant be included in students’ gross income?

No. Emergency financial aid grants under the CARES Act for unexpected expenses, unmet financial need, or expenses related to the disruption of campus operations on account of the COVID-19 pandemic, such as unexpected expenses for food, housing, course materials, technology, health care, or childcare, are qualified disaster relief payments under section 139 of the Internal Revenue Code. This grant is not includible in your gross income.

Can students who have received an emergency financial aid grant under the CARES Act and used some of it to pay for course materials that are now required for online learning because their college or university campus is closed claim a tuition and fees deduction for the cost of these materials, or treat the cost of these materials as a qualifying education expense for purposes of claiming the American Opportunity Credit or the Lifetime Learning Credit?

No. Because the emergency financial aid grant is not includible in your gross income, you cannot claim any deduction or credit for expenses paid with the grant including the tuition and fees deduction, the American Opportunity Credit, or the Lifetime Learning Credit. See section 139(h) of the Internal Revenue Code.